open ended investment company taxation

An open-ended investment company OEIC is a body corporate which owns and. Amalgamation of an authorised unit trust with an open-ended investment company.

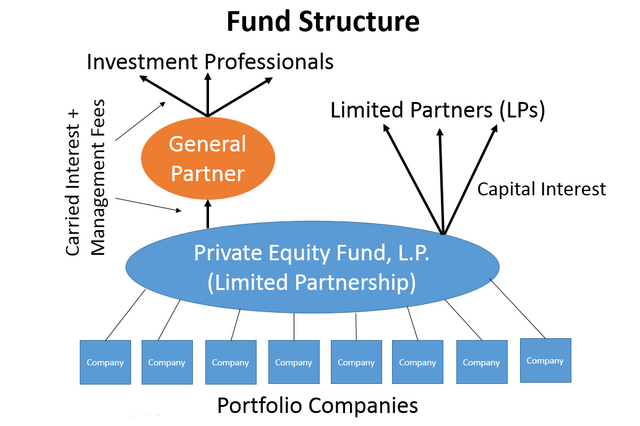

Everything You Need To Know About Fund Structure Accounting

The principal effects of the modifications in CG41562 - CG41571 are.

. OEICs are treated in practice as though they were. Unit trusts and OEICs have plenty in common in that. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c.

Strengthening the resilience of Money Market Funds MMFs are a type of open-ended investment fund considered to be a low-risk investment that gives investors credit risk. An open-ended investment company is a type of investment fund domiciled in the United Kingdom that is structured to. OEICs vs Unit Trusts.

These are the open-ended funds that you. The direct tax treatment of OEICs is established by the Authorised Investment Funds Tax Regulations 2006 SI2006964. 12 the 1992 Act of open-ended investment companies.

Any part of the gain which falls within the basic rate tax band is taxed at 10 and the balance will be taxed at 20. Unit trusts and Open Ended Investment Companies OEICs are collective investment schemes where investors purchase units or shares in a pooled fund which is run by. What Is An Open Ended Investment Companyoeic.

Open ended investment companies OEIC. It is also looking for investors in solar and wind energy he said. This rate is reduced to 001 for.

LTTA7090 Relief from Land Transaction Tax. Non-resident investors may be subject to a withholding tax rate ranging between 49 to 35 and in some cases 40. IHTM34141 - Qualifying investments.

This practice note provides an overview of the. A land transaction where a property that is. However such withholding tax rate generally may be.

HM Revenue Customs Published 20 March 2016. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c. 12 the 1992 Act of open-ended investment companies.

By Anthony Stewart Laura Underhill and Violet Marcel Clifford Chance LLP tax group and Simon Crown Clifford Chance LLP regulatory group. CG41572 - Open-ended investment companies OEICs. CG41562 - Open-ended investment companies OEICs.

In the coming months the Philippines will tap foreign investors for a 1300-megawatt solar project valued at. Taxation Notes CPA 2. Sections 613 and 617 of the Corporation Tax Act 2010 CTA10 These sections deal with open-ended investment companies OEICs and authorised unit trusts AUTs and set out the basic.

Meaning of open-ended investment company - section 613 Corporation Tax Act 2010. A sub-funds with the exclusive objective of. The company paid his medical insurance premiums to National Insurance Co-operation of shs1300000 8.

Why Bonds and Open-Ended Investment Companies OEICs From a tax perspective investment bonds and Open-Ended Investment Companies OEICs are at opposite ends of the investment. The Company is liable to an annual taxe dabonnement in Luxembourg representing 005 of the net asset value. Open-ended Investment Company OEIC funds give you the opportunity to enjoy the power of big institutional investors by pooling your money together usually for a number of years.

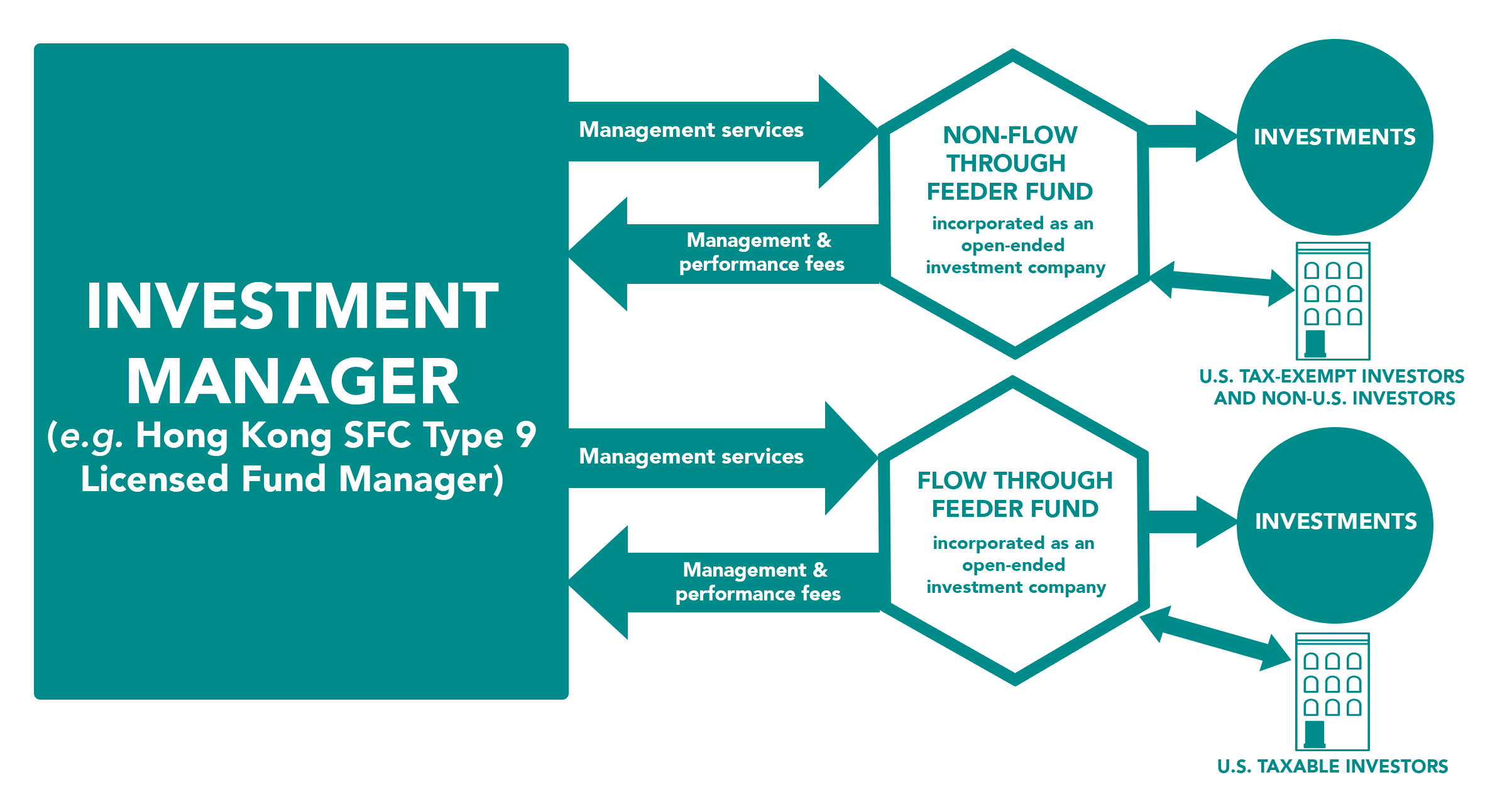

Guide On How To Start A Hedge Fund In Hong Kong Timothy Loh Llp

Investment Expenses What S Tax Deductible Charles Schwab

Solution Types And Purposes Of Collective Investment Presentation Studypool

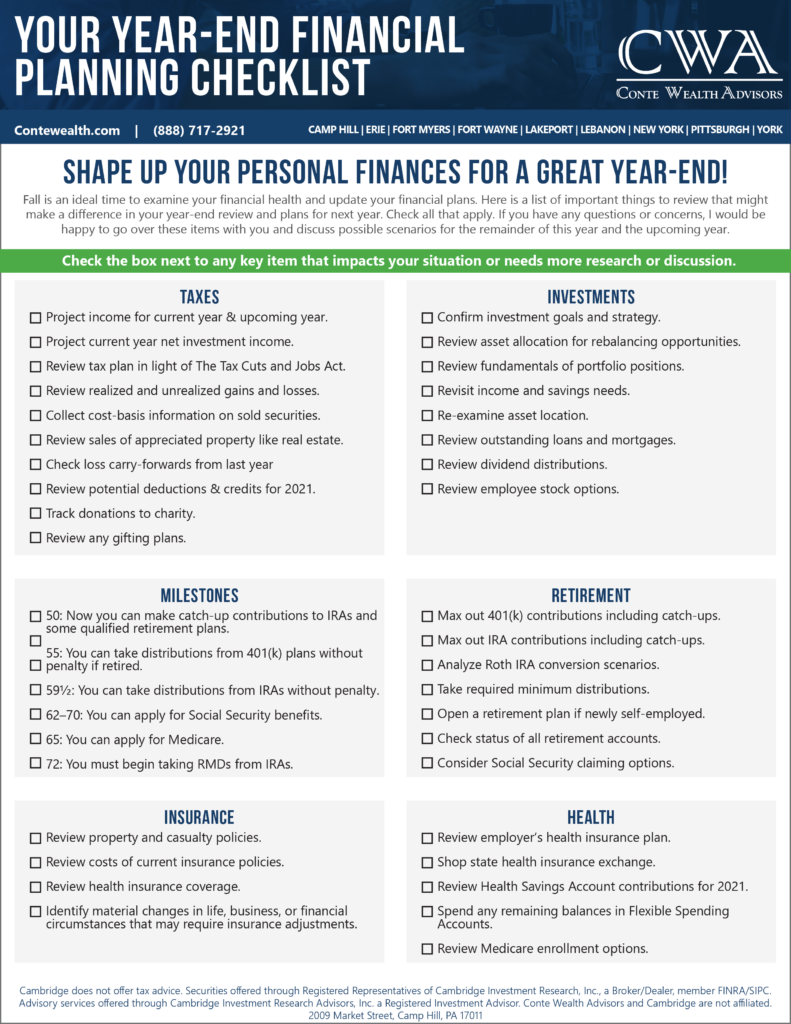

Your Year End Financial Planning Checklist Conte Wealth

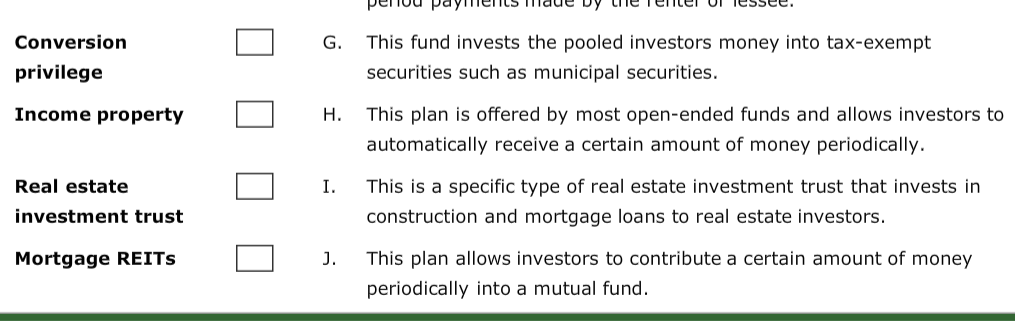

Solved Term Answer Description Pooled Diversification This Chegg Com

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

Closed End Vs Open End Investments What S The Difference

Choosing An Etf Small Trades Journal

Best Elss Mutual Funds To Invest In India 2022

Tax Wrappers And Successful Planning For 2021 Beesure

Broadridge Financial Solutions Inc Investor Presentation

Unit Trusts And Open Ended Investment Companies Coursework

What Is An Open Ended Investment Company Oeic

What You Need To Know About Capital Gains Distributions Morningstar

Index Funds Vs Mutual Funds The Main Differences

:max_bytes(150000):strip_icc()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund